Laoyapi

好像整个世界都在使用加密代币和 NFT。许多业内人士担心,这种全民上头的淘金热,正在扭曲经济以造福专业投资者。

又好像整个世界都在转向 Web3,从来没有人问为什么要这样做。突然之间,出现了 Web3 媒体公司、Web3 广告公司、Web3 工作室、Web3 营销策略和Web3 发布平台。LimeWire 和 MoviePass 已经死里逃生,正如他们的一位 CEO 所说——“通过 Web3 技术”他们获得了“新驱动”。Web3 显然不仅是“改造游戏”和“重新设计房地产规则”那么简单,它是互联网的未来,甚至可能是整个全球经济的未来。

很少有人能就 Web3 到底是什么(不是什么)达成一致。这没关系。对投资者而言,重要的是 Web3 是企业家们纷纷涌入的热门新事物。风险投资家 Hadley Harris 告诉我,他最近查看的 Web3 推介中大约有一半,半年前甚至都还没“诞生”。Alchemy 公司非常支持 Web3 ,该公司认为自己是亚马逊网络服务的 Web3 基础设施等价物。它在 2 月份表示,“数百家成熟的 Web2 公司”正在使用这个平台转向 Web3。甚至新的制药公司现在也在采用 Web3“加密优先方法”,其中一个提高了向其临床试验参与者发行“加密货币代币”的可能性。

与许多企业家同行一样,专注于创造者经济的初创公司 Norby 的CEO兼联合创始人尼克·杰拉德(Nick Gerard)去年开始注意到,他的竞争对手也一个接一个地一头扎进了加密货币和 Web3 。杰拉德表示,Norby 的潜在投资者也在推动他向 Web3 迈进。

但杰拉德不禁对整件事感到困惑。他的客户,他认为最重要的人,恰恰很少对 Web3 技术表现出太大的兴趣。他告诉我:“我可以用一只手算出来我从这些人的嘴中说出“NFT”的次数”。尽管如此,他和团队的其他成员仍在考虑是否进行转换,担心他们错过了其他人在做的事情。

“没有人想成为保罗克鲁格曼,”杰拉德说,他指的是 1998 年的一句臭名昭著的名言,这位诺贝尔奖得主经济学家预测,互联网最终不会比传真机更重要。(他也是著名的反比特币和加密货币。)

Web3 的疯狂今年仍在继续,尽管科技行业一直在努力应对利率上升和股价暴跌。专注于加密货币的一家投资公司的合伙人说:“在过去的六个月里,这变得相当荒谬,”。根据研究公司 Pitchbook的数据,今年前三个月,排名前 15 的风险投资公司在 Web3 和 DeFi 早期和种子阶段交易中投入的资金比其他任何领域都多,这是他们连续第三个季度这样做. 总体而言,上个季度,早期和种子阶段的 Web3 世界的项目从顶级公司那里获得了 20 亿美元的资金,是第二大行业生物技术的两倍多,是传统金融科技的三倍。这些数字低估了该领域的总体兴趣和资金水平。根据研究公司 CrunchBase 提供给 Motherboard 的数据,区块链公司在 2021 年获得 180 亿美元的资金后,至少筹集了 95 亿美元。更多的火力正在路上。5 月下旬,在加密货币价格暴跌的情况下,Web3 最大的机构支持者之一,风险投资公司 Andreessen Horowitz 在对 P2E 游戏等 Web3 项目进行一系列高调投资后宣布,它已筹集了一笔 45 亿美元的巨额加密基金。

“这无疑是一场淘金热,”Branch 的联合创始人兼CEO代顿·米尔斯(Dayton Mills)说。米尔斯的公司在转变为 Web3 游戏平台之前,一直是一家苦苦挣扎的远程工作初创公司。但是当他开始谈论 Web3 愿景时,投资者的兴趣就飙升了。他说:“这是一个巨大的落差,有些人我甚至都没有见过面,他们只是通过电子邮件和我交流。” 他原本计划筹集 200 万美元,却在两周内收到 2000 万美元的投资承诺。“我们停了下来,因为它夸张的让人害怕。”

“这绝对是正在发生大事,”米尔斯补充道。“很多人都想加入,更多的人其实是害怕掉队。”

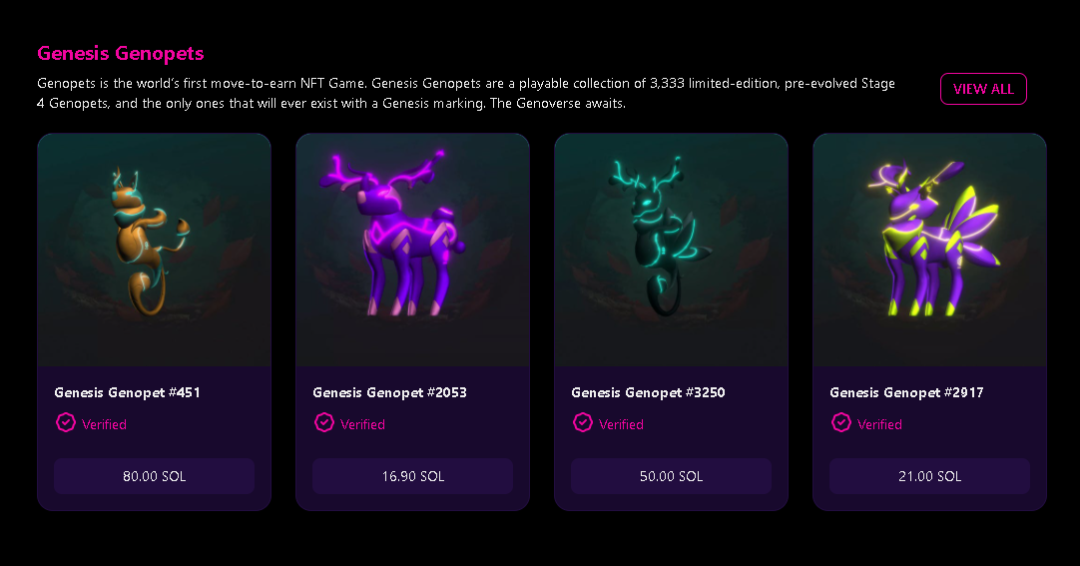

他们到底在搞什么,很难说清楚。“Web3 ”一词的说法,归功于以太坊区块链的联合创始人之一加文·伍德(Gavin Wood),他在2014年描述了一个理想化的网络版本,其中系统不信任组织,但几乎完全信任区块链技术。但这个词直到去年才进入主流文化词汇,当时它开始作为一个总称,用于收集有争议的金融技术产品,包括加密货币、区块链、不可伪造的代币、去中心化自治组织(DAO)、元宇宙和去中心化金融(DeFi)产品。

“这就像一个无意识的洪流。一个未经证实的产品,却无人掌舵,”一位风险投资家说。

对像安德森·霍洛维茨(Andreessen Horowitz)这样的一些人来说,将这些创新联系在一起的是,它们共同提供了一种理论愿景:人们“有能力拥有互联网的一部分”。例如,通过使用 NFT,它本质上是可交易的证明——你可以获得所有权收据。在这样一个世界里,人们可以在多个平台上使用他们的 NFT 甚至将其货币化,而不仅仅是在 Instagram 上。这样一个系统,支持者们相信活获得一个更公平、更公共的网络版本,从那些一直在人们的数据和创造力中获利的技术巨头手中夺回控制权,创造一个世界社区。因此,许多言论都涉及到使用 Web3 来获得真正增强的金融包容性”(引用了安德森霍洛维茨的话)最终将那些被传统金融结构边缘化的人也纳入其中。

这样的论点无疑是诱人的。很多人认为支撑社会的金融和互联网结构应当得到改善。但他们也相信这样一个事实,专业投资者不会仅仅为了改善世界而将资金投入这场豪赌。正如美国大学法学教授希拉里·艾伦(Hilary J. Allen)简洁地说:“风险投资家推动这一切的原因是为了赚钱。”

在 Web3 中,风险投资阶层和其他专业投资者发现了一个独特的吸引人的环境,他们认为而无需依赖虚拟现实或触觉技术的巨大飞跃,只需要利用监管政策套利,或者是利用全新的互联网市场,Web3 就可以赚到一大笔钱。

伦敦的软件工程师和加密评论家 Stephen Diehl 写道:“如果加密资产有任何创新,那不是在软件工程,而是在金融工程,”。

研究金融监管的艾伦认为,围绕授权和包容的言辞不过是一种 “玩世不恭 “的伎俩。她和其他人认为,这掩盖了Web3世界的某些方面,这些方面使它对风险资本家、亿万富翁和其他机构参与者很有吸引力——以至于他们已经积极行动起来,不顾该行业明显的诈骗、欺诈和监管审查的倾向,任然坚持向下扎下脚跟。

在这里,我们有一个基本上不受监管的市场,它已经成熟,充满了不明确的估值指标、可争论的未注册证券、奇特的金融产品、无数兑现的方法和面向公众的意识形态任务声明。

特别吸引人的是代币在Web3生态系统中的关键作用,这是一种新型的金融产品,监管机构仍在努力掌握,但风险资本家已经意识到,即使公司从未上市,他们也能快速兑现并获得丰厚的回报(如果他们上市,回报则会加倍)。

至少就目前而言,对于专业的赚钱阶层来说,这是一个接近完美的竞争环境,无论其效用如何,都会引发转型或死亡的压力。一位企业家非常沮丧地描述说,他最近与一家 VC mixer 的创始人交谈,该创始人正在构建一个“去中心化”的晚餐预订系统。当他问为什么需要在区块链上建立预订系统时,创始人简单地说:“这就是未来。”

至少,Web3 有可能带来更好、更充实的互联网版本。它同样有可能被证明是最严厉的批评者所担心的:对“包含反乌托邦噩梦种子”的网络进行“超级资本主义”重构。

许多 Web3 企业家和投资者似乎对他们创建更好的互联网版本的使命充满热情。对于这些人来说,Web3 不是一种浪漫的的可能性,而是一种全面的必然性,他们都在以一种近乎宗教般的热情谈论 Web3 。Evernote 前联合创始人兼首席执行官 Phil Libin 说:“我觉得这真的是意识形态层面的,而且很奇怪,因为 VC 往往不在意识形态层面进行投资。” 事实上,在最近一系列加密争议之后不久,包括 Luna 加密货币及其双胞胎“稳定币”UST 的5 月急剧崩盘后,Andreessen Horowitz 表示 Web3 刚刚进入其“黄金时代”。同一周,它宣布了投资了“Goddess Nature Tokens”——这是在 WeWork 前首席执行官亚当·诺伊曼 (Adam Neumann) 的 Web3 气候企业中出售的代币。

另一位 Web3 的信徒本杰明·科恩 (Benjamin Cohen) 最近创办了一个专注于 Web3 的投资基金,他在 3 月份接受一个加密货币网站采访时说,“区块链技术和智能合约技术将不可避免地应用于我们生活的方方面面。” 这不是一个孤立的观点。位于迈阿密的 DAO 创建工具 Upstream 的联合创始人 Alexander Taub 在 Zoom 采访中表示:“现在存在的每一家公司都将以某种形式的 Web3 存在,”。(戴着“Just DAO It”帽子的 Taub 补充说,“DAO 的潜在市场规模是数万亿美元。”)

Alloy Labs Alliance 的首席执行官 Jason Henrichs 曾与 Web3 项目讨论过潜在投资(并推进了一些项目)。技术作家和研究员 Evgeny Morozov 甚至将他们比作“令人讨厌的庸俗平均主义者,尽管有相反的证据,他们一直 [并一直] 坚持认为资本主义内部的客观发展不可避免地向社会主义过渡。”

从表面上看,他们的信心水平确实显得有些奇怪,或者至少为时过早。战略公司 National Research Group一月份的一项调查发现,接受调查的美国成年人只有 13% 知道 Web3 的含义,而且超过一半的人从未听说过这个词。大约在同一时间进行的另一项民意调查显示,不到五分之二的 Z 世代成员认为“元宇宙是下一件大事,并将在未来十年成为我们生活的一部分。”

根据 Electric Capita 最近的一项调查, Andreessen Horowitz 声称有22,400 名 Web3 创作者,到 2021 年底只有 18,000 名开发人员从事加密或 Web3 工作,这与全球超过2700 万开发人员相比简直是微不足道。

有人怀疑 Web3 的炒作是否合理。Libin 最初被 Web3 的“美丽”和“优雅”概念所吸引,他说。作为初创工作室 All Turtles 和虚拟相机应用程序 mmhmm 的首席执行官,以及 General Catalyst 的前风险投资人,Libin 的职业生涯是寻找能够以清晰的商业模式解决实际问题的公司。但当他开始听到越来越多的 Web3 公司的消息时,他发现自己无法理解在区块链上开发某些不使用内部数据库的项目会带来什么好处。当他开始质疑他收到的一些建议时,他发现这些看起来不必要又昂贵的技术通常用在黑客和诈骗事件里。

“Web3 的支持者正试图解决需要解决的实际问题。我只是不认为 Web3 是解决方案,”他说。“作为一名程序员,这对我来说没有意义。”

这是风投们经常重复的常见的 Web3 的反对论点,就像 1990 年代的互联网一样,早期的支持者就是少数人。研究该行业的加州大学戴维斯分校教授马丁·肯尼 (Martin Kenney) 表示,这种肆无忌惮的乐观对 Web3 来说并不新鲜,甚至可以算是风险和技术行业模式的核心。投资者的目标始终是出售公司,他们有动机瞄准热门行业,然后帮助提高对这些行业的兴趣。

“无论这个新事物到底是什么,大肆宣传它绝对符合 VC 的利益。不这样做你就是个傻瓜,”肯尼说。“所以要发给媒体。媒体告诉所有人这将改变世界,这是自从吐司发明以来我们遇到的最好的东西,无论它到底是什么,都能让投资者相信必须要拥有它。”

它可以令人信服。根据一项关于所谓“网络”效应的研究结果,在 1990 年代后期的互联网热潮中,众所周知,在此期间,在名称中添加“.com”的公司在更名后立即经历了“戏剧性”和“永久性”的估值上升,“无论公司对互联网的参与程度如何”。研究人员确定,这种所谓的“网络”效应可归因于“不惜一切代价与互联网产生联系”的愿望,即使这些公司“充其量只是松散地连接到它”。最终,繁荣变成了萧条,但在许多风险投资家兑现承诺之前。

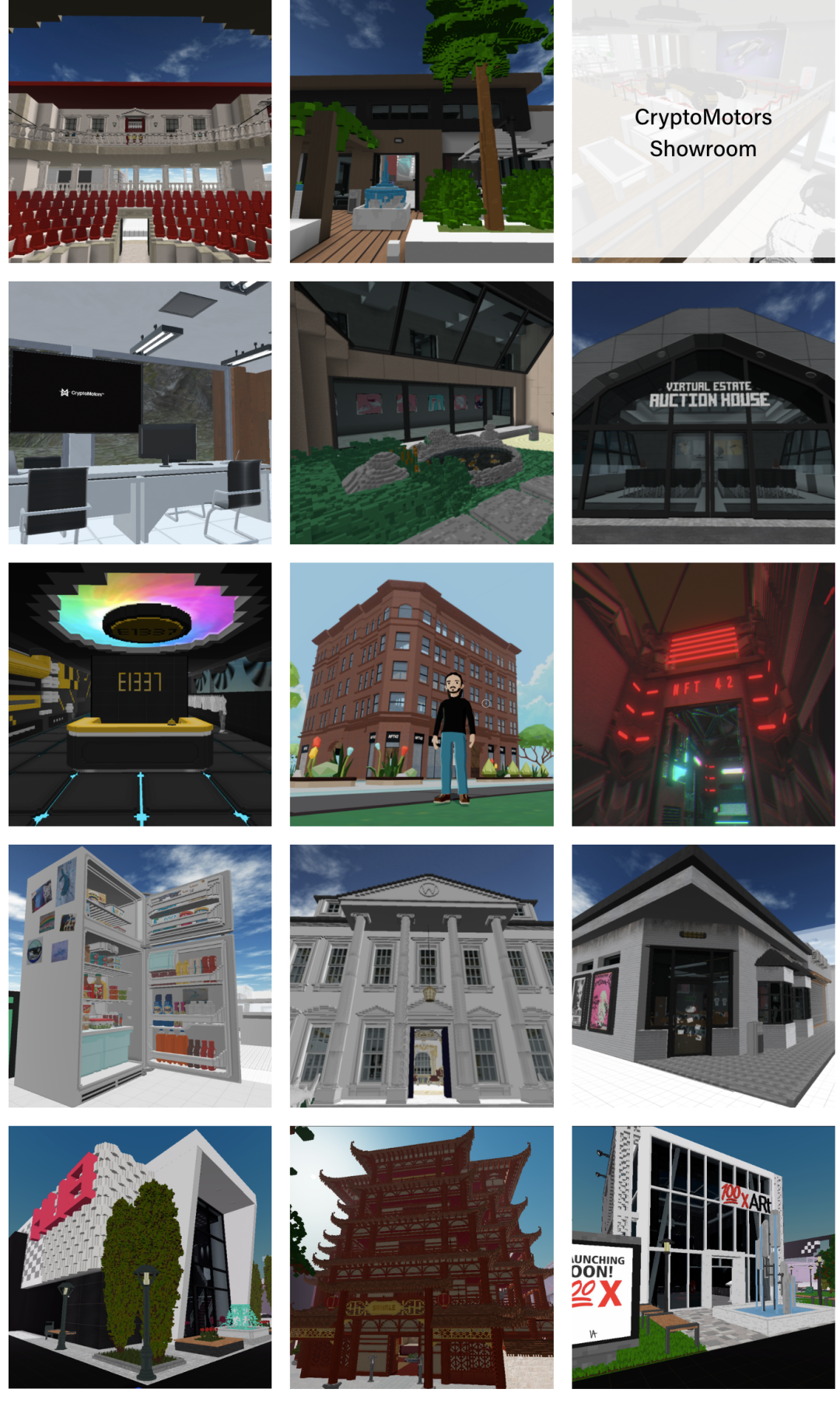

无可争辩的是,炒作周期又回来了。一家专注于加密的投资公司的管理合伙人凯尔·萨马尼 (Kyle Samani) 告诉我,尽管他的大多数有限合伙人并不总是完全了解 Web3 背后的技术,但他们希望了解“所有这些”。花旗的一份研究报告估计,仅 Web3 的一个组成部分“元宇宙”就可以在八年内拥有13 万亿美元的总潜在市场和多达 50 亿用户。(相比之下,整个加州的住房存量目前价值9.2 万亿美元;花旗基本上声称相信,到当前的中学生大学毕业时,元宇宙将或可能超过除三四个整个美国行业之外的所有行业。)

创立 Indiegogo 和另类资产投资搜索引擎的早期投资者 Slava Rubin 表示,这种热情让他想起了 1990 年代的繁荣的电子商务。他说:“只要有变化,就有机会取代传统玩家,并有可能在投资上赚到很多钱,”。

然而,这一次,世界上最知名的品牌也纷纷涌入,以免落后。星巴克、ESPN、Spotify 和 GameStop 正在制定 NFT 计划;美国最大的 401(k) 提供商 Fidelity Investment允许人们将退休储蓄存入比特币。高盛正在提供加密支持的贷款。JPMorgan Chase、Gucci 和 Miller Lite 正埋头于虚拟世界。Google 有一个专门的 Web3 团队。Facebook 为了表达雄心直接改名了。

在上个世纪,风险资本家支持的行业改变了世界并创造了数百万个就业机会,其中最著名的是早期互联网。哈佛商学院教授乔什·勒纳(Josh Lerner)也研究风险投资行业,他说,风险投资课程里教的也许并不是真理。作为一个例子,勒纳引用了 2000 年代末 VC 资助的清洁技术的繁荣和萧条作为最近的例子。

“事实证明,不仅技术比他们想象的要困难得多,而且许多企业经营得非常糟糕,一些业内最好的公司只是被他们烧掉大量投资者资金的热情所蒙蔽。”勒纳说。

Tomasz Tunguz 对 Web3 没有兴趣是因为它的意识形态基础。和许多投资者一样,由于 Web3 生态系统的经济特殊性,他看到了赚大钱的机会。

Tunguz 是 Redpoint Ventures 的风险投资家,他撰写了一篇关于该行业的热门博客,在他注意到 Web3 市场既具有资本效率又可以扩大到巨大规模后,他于去年上半年开始活跃于 Web3 市场。8 月,Tomasz 和其他许多人一样惊讶地看着区块链平台 Solana 的代币价格在 9 月中旬从 40 美元上涨到 190 美元,到 11 月市值一度达到近800 亿美元。

“这确实让很多人看到了这些公司的规模,”Tunguz 说。“规模迫使你弄清楚发生了什么。”

越靠近,投资机会就越大。一方面,这些企业没有明确的衡量标准。在过去的 20 年中,投资者和企业家共同开发了相当可靠、标准化的财务模型,使他们能够在将传统软件业务与类似的较早业务进行比较后自信地对传统软件业务进行评估。“大多数软件业务都非常了解。一家初创公司走进来,风险投资家和私人市场投资者一样清楚地知道它应该值多少钱,”Tunguz 说。

“在 Web3 中,情况并非如此,”他补充道。“没有人知道如何评估这些业务。” 他认为这不是一件坏事,而是表明 Web3 行业正处于“广泛发明而非优化”的时期。“没有人知道如何评估这些企业的价值……它太新了。”一位风险投资家说。

“我还没有与 Web3 公司谈过‘客户获取成本’或‘投资回收期’这样的词。它是如此年轻,以至于人们并不担心单位经济学,”Tunguz 说。(帮助发现“网络”效应的剑桥金融学教授 Raghavendra Rau 同意 Web3 行业的基本面“难以解读”,其他人也应该同意这个观点。)

Tunguz 知道,对某些人来说,缺乏对经济基本面的关注听起来很“疯狂”,他确实相信,与风险基金投资组合中的典型初创公司相比,Web3 风险投资的失败比例“明显更高”。但他也将 Web3 不明确的估值指标视为与 Web 2.0 世界相比完全不一样的金融机会,Web 2.0 已没什么新花样,事实证明投资者更难获得优势。

Tunguz说:“暴富的方法之一就是利用信息不对称。如果你知道一些我不知道事情,并且你利用这些信息进行交易,你就会赚到一大笔钱,对吧?在股市,这是违法的。它被称为 MNPI——重要的非公开信息。你不能那样做。在私人市场,你可以。”

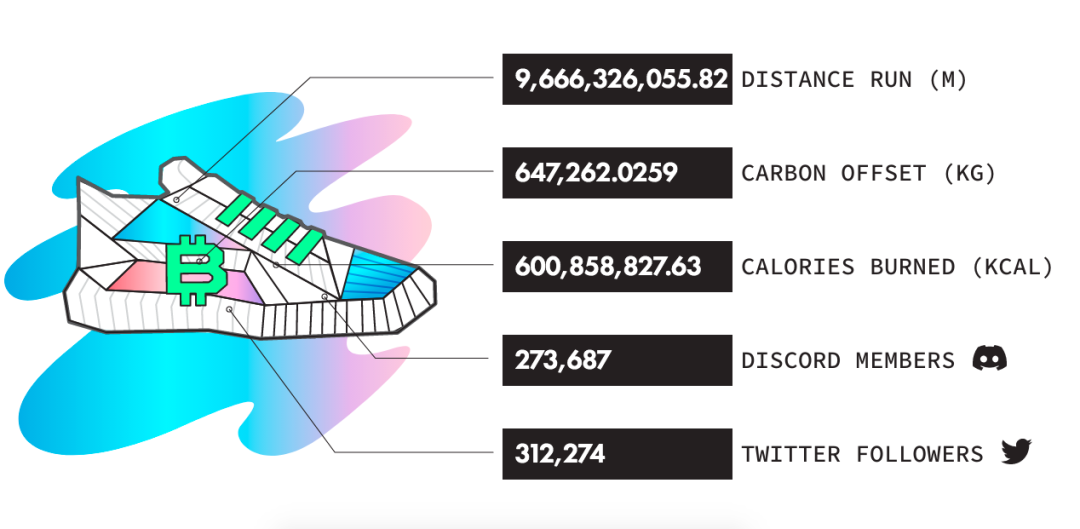

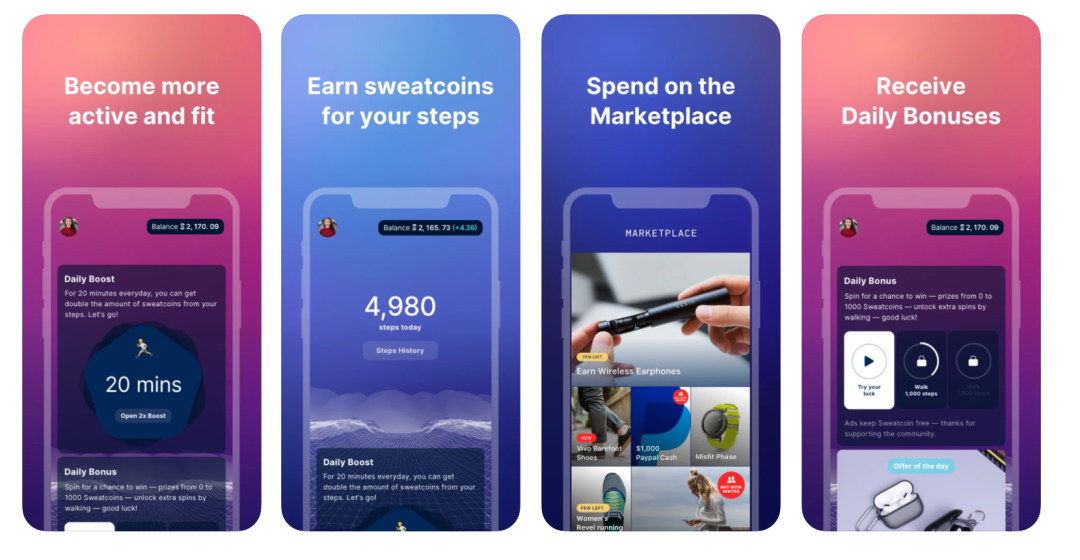

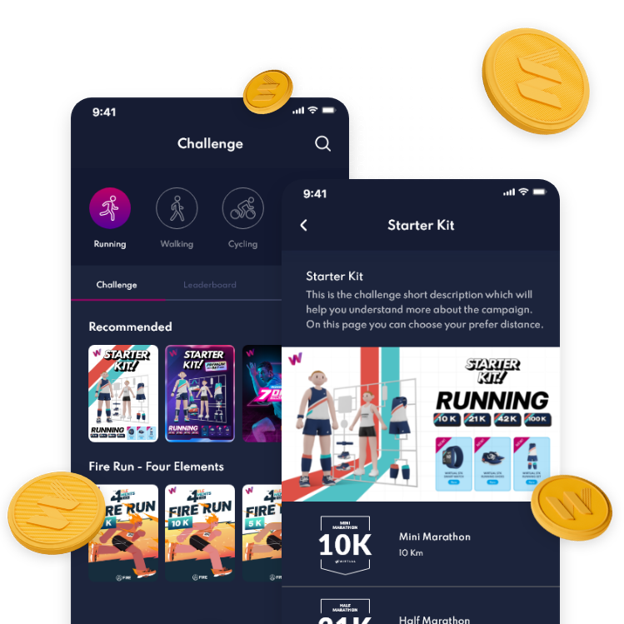

Tunguz 被 Web3 市场吸引的另一个原因是:他开始看到加密货币的核心创新之一——代币的财务潜力。“代币”一词在加密领域可能意味着很多东西,这使得很难以任何方式同时定义包罗万象的东西。简单地说,它是任何区块链上的可交易单位,但它已经具有多种形式和功能:代币可以是货币,就像比特币一样;它们可以代表有投票权的股份,就像 DAO 治理代币一样;它们可以是数字收藏品,就像无聊猿的 NFT;它们可以通过在线工作获得,就像“玩赚钱”游戏Axie Infinity 一样。

但专业投资者也开始将它们视为加密项目的可交易股份。据其联合创始人兼管理合伙人凯尔·萨马尼 (Kyle Samani) 称,位于奥斯汀的投资公司Multicoin Capital就是其中一家公司,“主要”投资于代币而非初创公司的传统股权”。Multicoin 最近的回报简直是惊人的。据报道,其对冲基金资产在 2017 年 10 月至 2021 年 12 月期间飙升了 20,200%,其风险基金获得了 28 倍的回报。Samani 表示,他已经想出了如何处理“加密资产”的投资——他认为“加密货币”这个词并不准确——应该使用类似于传统投资者可能对股票进行分析的方式来分析它。

一家专注于加密货币的投资公司的合伙人说:“你可以认为这些代币获取价值的机制与初创公司的股权相当。”

“这些代币获取价值的机制可以与初创公司的股权相媲美,”萨马尼告诉媒体。“其中许多资产直接获得收入,就像初创公司获得收入一样。如果一项资产获得了收入,那么你可以使用贴现现金流模型对估值进行建模。” 这样的说法是许多人认为代币应该像投资合同或证券一样受到监管的原因,因为人们投资于代币“具有从他人的努力中获得利润的合理预期”——符合证券资格的法律标准.

“大多数 web3 顿悟的内容是‘如果我们不卖产品,我们卖股票怎么样?’” Meta 产品经理、加密货币愤世嫉俗者 Dare Obasanjo写道。

Tunguz自己将基于代币的奖励系统称为“以‘股权’支付客户”,他写道,随着“网络变得更有价值,用户在公司中的股份也变得更有价值”。这样做为初始用户投资于公司的成功提供了一个理由,有时甚至在公司知道它将生产什么产品之前。这就是为什么风险投资家会说“ Web2 公司从产品开始,而Web3 公司从社区开始。” 。例如,受 Axie Infinity 的启发,Alex Kehr 在他的创业公司 Superlocal 中采用了一种基于代币的方法,这是 2020 年代的 Foursquare 版本,人们可以通过“地点打卡赚取加密货币”。他说,该令牌将让人们“在我们的应用程序还没有太多人的时候做一些事情”。(他特别认为,P2E游戏代币在未来不太可能被视为证券。)

Andreessen Horowitz 在其最近的“加密状态”报告中认为,Web3 公司以代币为中心的结构以非代币化公司无法做到的方式调整了用户、创造者、建设者和投资者的激励机制。报告称:“Web3 让网络参与者齐心协力,朝着一个共同的目标——网络的发展——共同努力。” 所以逻辑上,理论上他们真的可以做到。

但Tunguz(和其他人)看到了专业 Web3 投资者的机会,但那些停留在早期网络迭代中的人无法获得这些机会。他意识到该行业非常适合“监管套利”,即企业转移到法律更有利的司法管辖区或将自己定位为一种类型的公司而不是另一种类型的公司,以避免监管监督(例如,拼车公司将自己定位为应用程序初创公司,而不是出租车公司)。正如 Tunguz 所说,Web3 属于“法外之地”,它允许公司获得传统的公司无法获得的资金。

传统上,风险投资家必须等待数年才能收到投资回报,通常是在首次公开募股期间。由于代币可以随时出售,Tunguz 意识到他们的 Web3 投资者可以使用具有“即时流动性”的资产,即使公司从未上市,也可以带来回报。如果他们这样做,那就更好了:股权投资者可以两次套现。

另一个被称为“质押”的与代币相关的过程——对 Tunguz 特别有吸引力。对他来说,这似乎就像他们进入金融领域的决策一样确定无疑。正如加密货币交易所 Coinbase 所说,通过质押,代币的所有者将其移交给一个项目以用作流动性——例如加密贷款——并作为交换获得“随着时间的推移按百分比率的奖励”。Tunguz 意识到,这意味着无论其价格上涨还是下跌,他都可以通过代币赚钱。很快,他就积极投入代币领域以产生他认为非常高的“利率”。(“代币可以产生 15% 到 100% 的固定收益,”Tunguz 说。)

在 Web3 领域发现如此巨大的固定收益证明了 VC 的经济利益,但 Tunguz 预计,对于专注于债券市场的机构投资者来说,这将非常令人兴奋——“购买抵押贷款支持证券、CDO、抵押债务,基本上是导致 2008 年金融危机的因素,”他告诉我。“这些是真正想要进入 DeFi 的大型机构资金池,因为它们可以产生收益。”

“这些大型机构正在研究这些加密代币,并研究是否可以将自己与代币价格上涨或下跌隔离开来,但如果我能在一致的基础上捕捉收益,那么我可能会产生 10 倍于债券上的利润,”他继续说道。

然而,在我们交谈后不久,这种系统固有的风险就变得很明显了。5 月,价值 400 亿美元的 Terra-Luna 生态系统崩溃了。一个主要因素是附属贷款协议 Anchor 承诺20% 的质押收益率。一旦人们开始对这种收益率的可持续性失去信心,他们就会急于撤出资金,导致 Terra 的算法稳定币 UST 与美元脱钩,其姊妹加密货币 Luna 急剧崩盘。

据报道,几天之内,Terraform Labs 的早期和最大投资者之一,专注于加密货币的对冲基金 Pantera Capital,在 UST 倒闭之前悄悄兑现了“大约”五分之四的投资,170万美元的投资获得了在 1.7 亿美元收益。这一消息激怒了许多散户投资者,他们认为这证明了许多加密货币领域的人所怀疑的:专业投资者获得了早期优势,大声推动项目,悄悄地兑现——抛售——然后转向下一个代币。

去年,投资者和播客 Jason Calacanis 和 Chamath Palihapitiya 开玩笑说要抛售他们的 Solana 代币的视频片段引起了类似的愤怒,因为区块链在早期得到了专业投资者的大力支持。科技记者 Casey Newton最近写道:“没耐心的 VC 可以操纵项目的一种方法,就是坚持要求初创公司提供代币作为其项目的一部分,并要求为 VC 预留一定数量的代币。这样一来,一旦代币可以在公共加密货币交易所进行交易,风投就可以提前几年兑现部分投资。或者,如果项目在出售或上市之前就失败了,风险投资人可以从一项本来会是亏损的投资中获得利润。”

Newton 在 ApeCoin 代币发布后发表了评论,该代币几乎与 Yuga Labs 正式相关,Yuga Labs 是 Bored Ape 游艇俱乐部或 BAYC 背后的公司。ApeCoin 的组织机构 ApeCoin DAO 已将近四分之一的代币献给了 BAYC 的联合创始人和“帮助使该项目成为现实的公司和个人”,据报道其中包括很多风险投资家。

这种内部交易是加密领域的许多人开始怀疑专业投资者阶层的原因。Web3 项目已经开始要求 VC 锁定他们的持股以避免专业的拉高出货,而 VC 已经基本不写那些关于人们为什么应该拿他们的钱的文章。(“如今,风险投资有很多替代品,尤其是在 web3 中,但在艰难时期,几乎没有什么替代品能够坚持下去,”投资人 Fred Wilson在 12 月写道。)

然而,风投对创业系统的影响力毋庸置疑。一位“风投朋友”最近告诉 Newton,“他们听说初创公司被迫提供代币。” Norby 的 CEO Gerard 也同样开始听说公司面临铸造代币的压力。“他们未能在他们的 Web2 公司中找到激励措施。因此,在 Web3 中构建一些东西,对于某些人来说几乎是一种逃避。他们就像,’哦,我们只要搞一个令牌就万事大吉了。’”

但他对它们了解得越多,就越怀疑。他开始相信,代币,不是意识形态上的 “完全去中心化的互联网的未来”,而是投资者对Web3的许多兴趣的背后原因。他告诉我。在他看来,一家投资公司可以投资一家初创公司,以换取股权和内部信息,然后通过谈判获得囤积的早期代币。Gerard 说:”我现在拥有的是获取不对称信息的途径,我有一条与创始人直接联系的线路,而Discord的每一个人都没有。我可以接触到财务信息。我知道用户采用率是否在下降。我知道使用率是否在激增。我知道创始人是否有抑郁症,是否迷上了Adderall,是否正在失去控制。

然后,在出现第一个内部问题迹象时,投资者可以将代币转储到“报价-取消报价社区”,Gerard 说。

“这是这个行业运作方式的根本变化,”他说。“他们中的一些人对此心知肚明,但他们仍然能够用围绕所有权和社区的语言来表达所有这些。”

去年夏天,当 Gerard 权衡自己的重心时,他不断听到一些创始人做出转变,仅仅是因为这样做更容易筹集资金。

一位风险投资家要求我不要使用他的名字,以便他可以自由地谈论他公司的投资,他承认他自己的一家投资组合公司也在这样操作做,其他创始人和首席执行官也同样表示,他们注意到初创公司涌入Web3 后需要更多资金才能生存。

“他们未能在他们的 Web2 公司中找到激励措施,” Mills 说,他本人也转而创办了一个 Web3 游戏平台,他在谈到这些公司时说。“所以在 Web3 中构建一些东西,对某些人来说几乎是一种逃避。他们就像,’哦,我们只是要在它上面搞一个令牌就万事大吉了。’”

“我们看到很多这样的情况,”风险公司Uncork Capital的创始人Jeff Clavier同意。”Web3是新的趋势,很多企业家把它作为一种事后的点子来添加进去。” Tiny Rebel Games首席执行官Susan Cummings说,试图在表面上 “偷工减料 “以筹集资金,对创业公司来说是一个危险的赌注。在Web3中这样做是很难解读的。一位投资者指责卡明斯自己在向他推荐Petaverse网络时,加入了不必要的Web3元素,Petaverse网络是一个Web3项目,人们在其中建立数字宠物,然后与他们一起生活在各种元宇宙中。”他拒绝了我们,说我不明白为什么你需要区块链,”她说。”这倒是真的。你可以把它存储在一个数据库里。” 她争辩说,基于Web3的想法的潜在互操作性和所有权 “使它变得更好”,并继续筹集700万美元,这个数字比她设定的目标高出一倍。

每个人似乎都能同意的是,这股热潮创造了很多蒸发品和无用的创业尝试,只是为了快速致富,即使没有人愿意在记录上说出名字。

“使用 Web3的概念,投资者就会盲目地投入资金并将估值夸大 2-3 倍。”

企业家和风险资本家都将那些利用 Web3 元素以筹集更多资金的公司描述为“骗子”。风险资本家说,这样的公司很容易被看穿。即使这种策略在很大程度上是正确的,一位创始人告诉我,他注意到加入 Web3 元素会增加投资者的兴趣,无论其相关性如何。“加入 Web3,”创始人说,“投资者会盲目地投入资金,将估值夸大 2-3 倍。”

Norby 的 CEO Gerard 在决定是否转向 Web3 时,经历了真正的“自我怀疑”时期。有时,他担心自己是个傻子。但最终,他决定,如果他的客户不要求这样做,他就没有理由转向。

“如果这是我们开始从客户那里听到的东西,那么这绝对是我们要研究并找出对我们有意义的版本,”他告诉我。但就目前而言,他补充说,“我们不能强迫人们收下他们不想要的东西。”

目前的问题是监管套利方将持续多久。监管机构正在包围许多人认为是非法的金融活动。最近几个月,美国证券交易委员会主席加里·根斯勒一再重申,他认为许多加密代币应作为证券进行监管。“我们不要冒险去破坏 90 年的证券法,人为的制造一些监管套利或漏洞,”他在宾夕法尼亚大学 4 月的法律会议上说。

尤其是令牌化的兴起让 Web3 的批评者感到沮丧。Meta 的 Obasanjo表示,“如果你说它授予投票权但不授予所有权,那么在没有监管的情况下有效地出售股票是合法的”,这是一个“令人兴奋的”和“巨大的黑客行为”。研究区块链技术和数字资产的 Forrester Research 副总裁 Martha Bennett 将其描述为“对系统的滥用”。英国加密货币评论家斯蒂芬·迪尔(Stephen Diehl )辩称,“加密代币作为股权代理计划”通过允许人们“进行内幕交易、洗盘交易、拉高抛售”而不受惩罚,从而使 1920 年代的金融规则重新发挥作用.

“我们所拥有的代币是另一种创造杠杆的方式。现在,资产本身是合成的,”一位法学教授将加密代币与信用违约掉期进行比较时说。

研究金融监管的法学教授 Hilary J. Allen 最近花费了大量时间研究构成 Web3 的金融产品与导致大萧条的工具集合之间的相似性。在代币中,Allen 认为其核心创新可与信用违约互换相媲美。她说,两者是不同的——信用违约掉期允许许多人对债券的未来表现进行押注——但归根结底,两者都有助于大大提高金融体系的潜在杠杆率。

“在经济繁荣时期,杠杆作用很大,因为它可以让你的利润成倍增长。但这意味着该系统要脆弱得多,因为即使你的投资损失很小,也会将你消灭,”她说。“我们所拥有的代币是另一种创造杠杆的方式。但现在,这不是很多合约引用债券的问题。现在,资产本身是合成的——我们可以创建的代币数量没有限制。”

Allen 在讨论她担心的最坏的未来情景时毫不掩饰:“重大的系统性内爆”。财政部长珍妮特耶伦表示,加密行业尚未达到引发“金融稳定担忧”的规模,总统乔拜登表示支持“负责任的”加密创新,但金融民主化的言论仍然让 Allen 想起了次贷之前房地产泡沫破灭,当抵押贷款支持证券和债务抵押债券等一系列复杂的金融创新被视为新一批人可以获得财富的途径时。现在,Allen 和其他人希望 Web3 系统将被置于在历史重演之前能够被监管。

支持 Web3 的风险投资家 Tunguz 已经为这一天做好了准备,但直到那时才能收获回报。

“无论是哪一年,都会有 2033 年的证券法,”Tunguz 说。“只要法规出台,我们就会做出回应。但我认为这里绝对有机会以一种有利于生态系统中每个人的方式赚钱。”